Self billing

What is Self-Billing and how do I agree to it

If you are a Limited (Ltd.) Company freelance worker, agreeing to the self-billing agreement allows JoinedUp to create your invoices for you based on the start and stop times of your shifts and the rates that you are being paid.

This is designed to save you paperwork, and ensure that your invoices are accurate, are formatted legally, and can therefore be paid without delay.

In summary, the agreement confirms

-

The date from which invoices will be issued.

-

The client agrees to issue invoices for all supplies made to them by the self billee (the worker) until the end of the agreement.

-

That invoices will show the supplier’s (your) company name, address, and VAT registration number.

-

The end date of the agreement (this is one year and then you’ll need to renew the self-billing agreement again.)

-

The supplier (you) will notify the client (agency/JoinedUp) of any issues with invoices.

-

The supplier (you) will notify the client (agency/JoinedUp) of any changes to their Ltd. Company or VAT details.

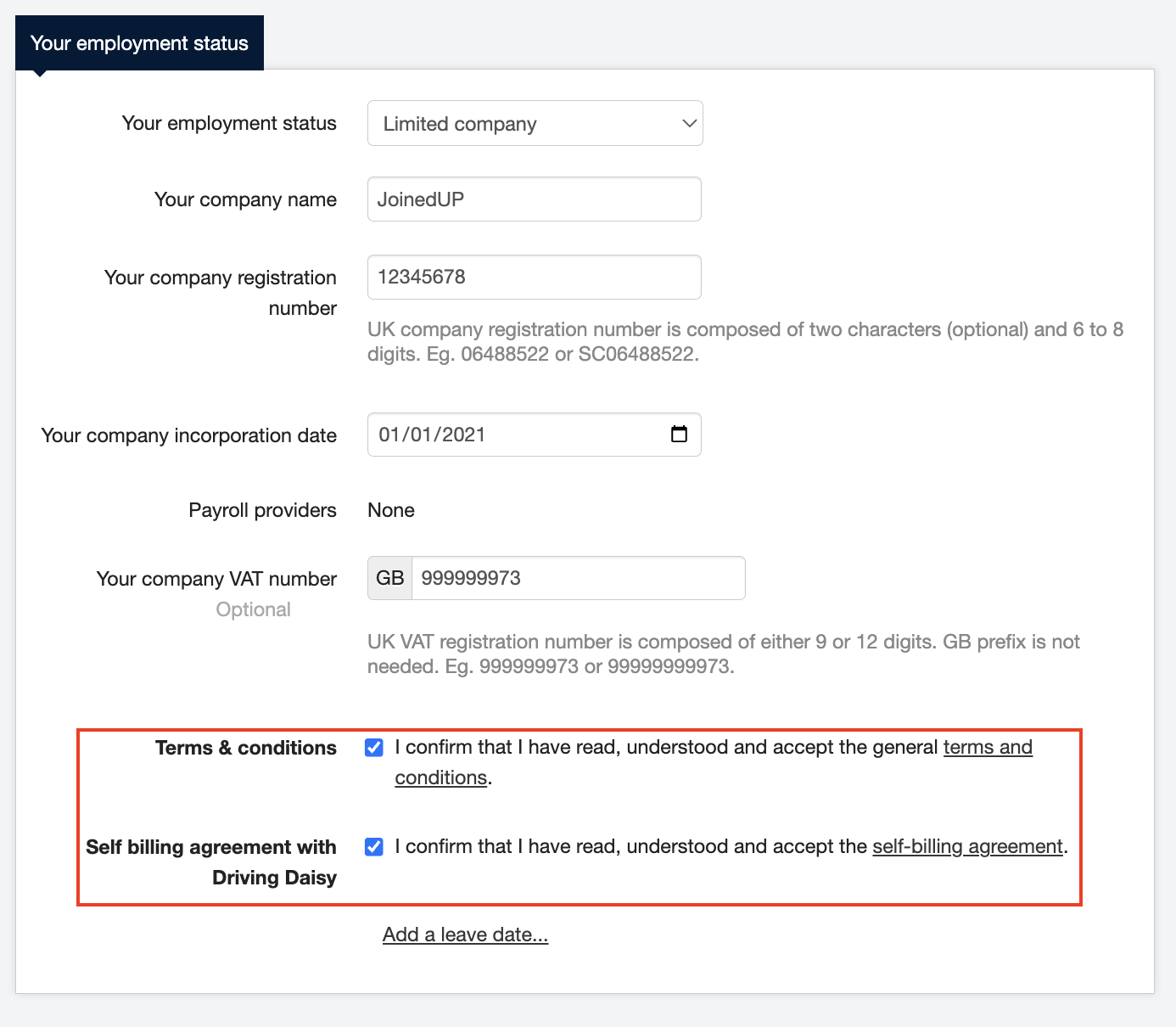

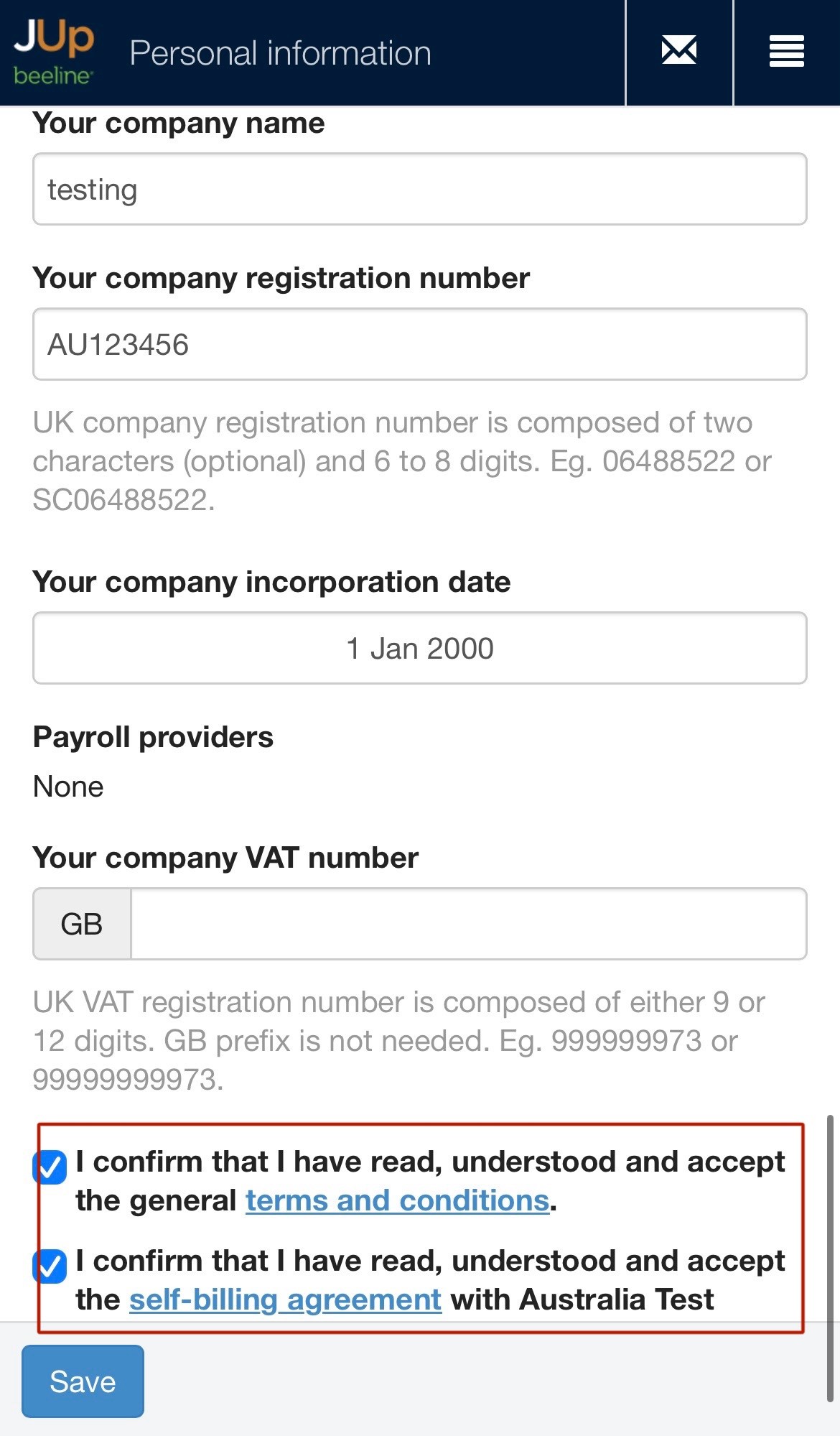

On registering you will be asked to agree to self-billing along with the general Terms & Conditions of JoinedUp.

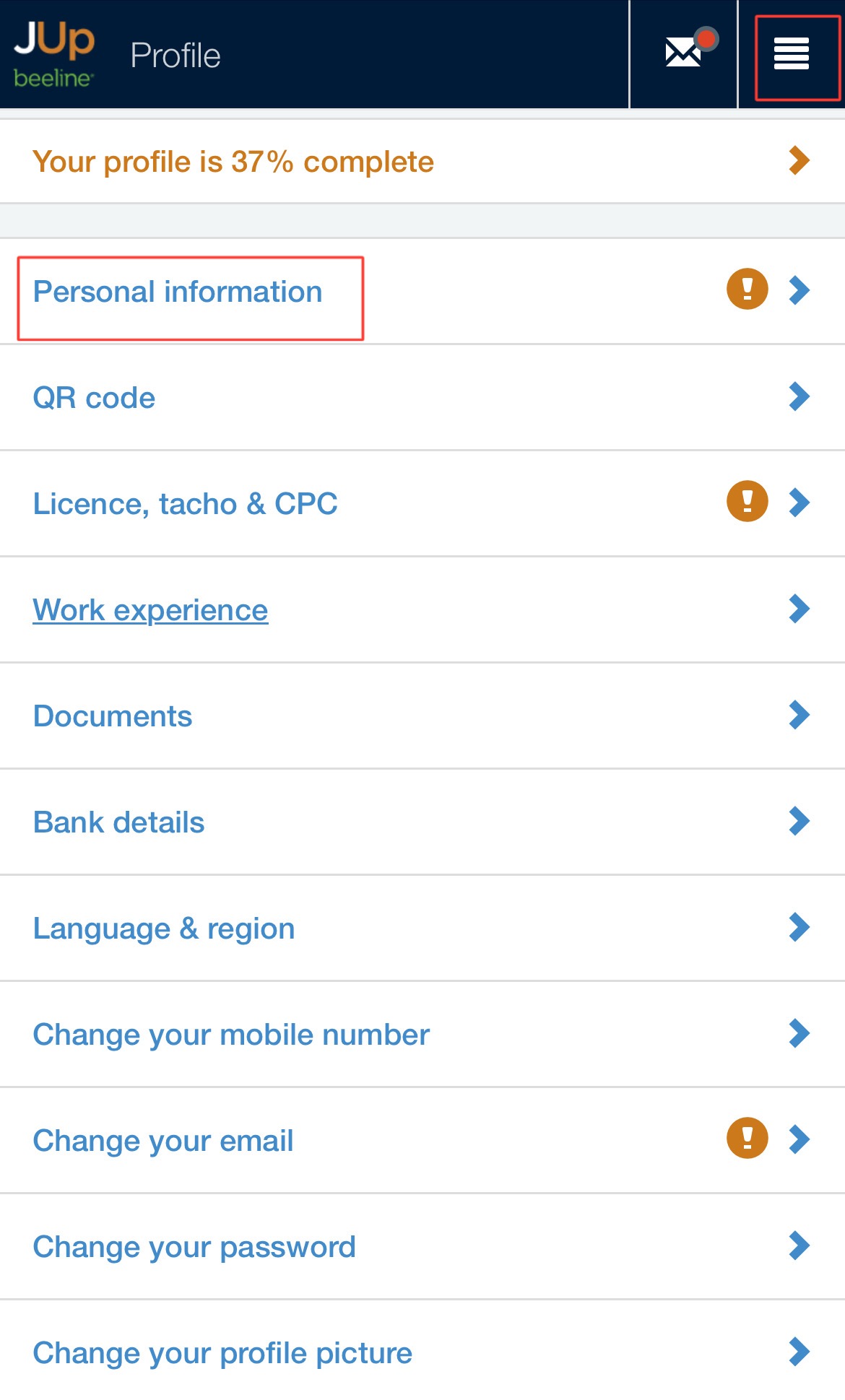

This can also be found and agreed to under the personal information and employment status section of your profile.

JoinedUp will also send prompts and reminders when the self-billing agreement needs to be made. (There will be a link to click to get this agreement.)

Please note JoinedUp requires self-billing to be agreed to in order to create your invoice and process payroll.